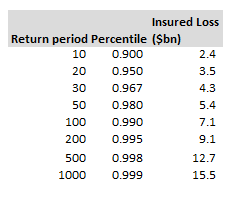

German Flooding - tail position - update31/8/2021 This post is a follow up to a previous post, which I would recommend reading first if you haven't already: https://www.lewiswalsh.net/blog/german-flooding-tail-position In our previous modelling, in order to assess how extreme the 2021 German floods were, we compared the consensus estimate at the time for the floods (\$6bn insured loss) against a distribution parameterised using historic flood losses in Germany from 1994-2020. Since I posted that modelling however, as often happens in these cases, the consensus estimate has changed. The insurance press is now reporting a value of around \$8.3 bn [1]. So what does that do for our modelling and our conclusions from last time? Firstly, in my defence, at the end of the post I did mention the result of a brief sensitivity analysis I carried out: “the analysis is dependent on the \$6bn figure being reasonably accurate. … if it were 50% higher (\$9bn), we’d be talking about a 1-in-200 year event.” And guess what happened? The \$6bn figure was out by a fair margin, and we are now closer to a \$9bn insured loss, much further into the tail than we initially thought. Here was our table of return periods from last time, let's see where our new estimate sits: \$8.3bn sits somewhere between the 1-in-100 and 1-in-200. Calculating the exact return period from the 25k simulations we computed last time, gives an exact return period of 1-in-160. i.e. based on historic experience up until this storm, we would have expected a storm of this severity only once in 160 years. However, the fact that extreme events like these are cropping up globally with increased frequency suggests the new, 'true' return period is now much shorter than this. And the above is much stronger evidence than our previous pick (1-in-65 years based on an insured loss of \$6bn) that something structurally has changed. [1] https://www.theinsurer.com/news/german-insurers-now-expect-7bn-loss-from-july-flooding/17863.article |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Leave a Reply.