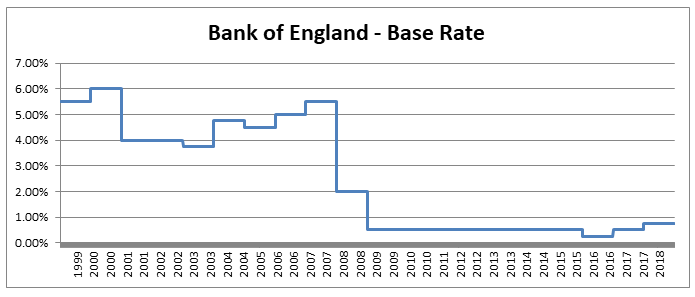

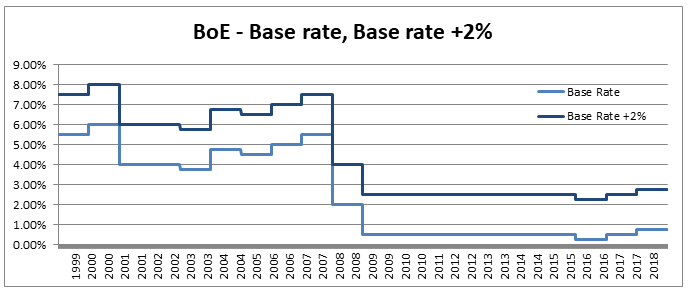

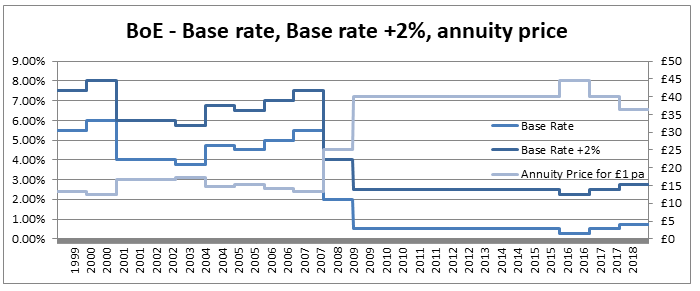

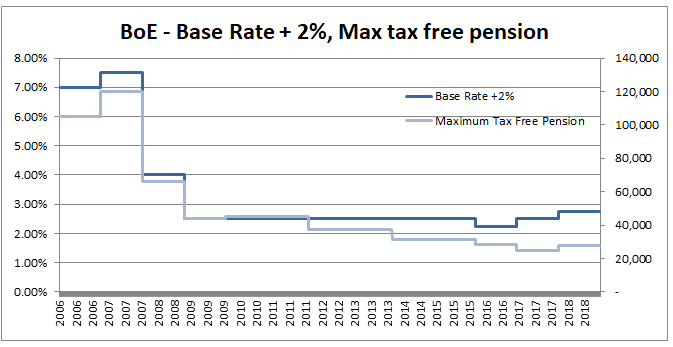

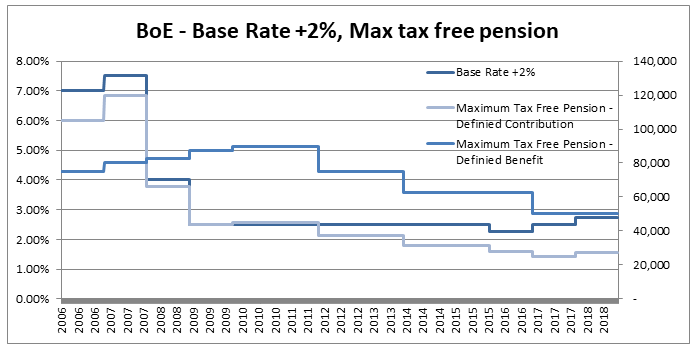

Pensions and Tax12/10/2019 Pensions and tax you think to yourself - he’s managed to find the two most boring subjects possible and now he appears to be planning to write about a combination of them! Is this some sort of attempt to win an award for the most boring and tedious blog post every? Well what if I told you this blog post, whilst being about pension and tax was also about a burning social justice, about high finance, and about death? Would you find that interesting? Okay, so I may got slightly carried away in that last paragraph and over sold slightly. This is less of a 'burning social injustice', and more an 'unfair outcome' which happens to only affect people who are already well off - but someone has to write about this stuff right? And the current status quo is genuinely unfair I promise. Lifetime Allowance Before diving into the unfairness I mentioned earlier, we need to briefly set the scene. Let’s think about all the types of tax that the government levies on us; we get taxed on our income (income tax), we get taxed on our property wealth (council tax), we get taxed on our wealth when we die (inheritance tax), and we get taxed when we buy things (VAT and other sales taxes). Since the government taxes just about every financial transaction we make, they can tweak all these different types of tax to incentivise and disincentivizes certain behaviours. One thing governments have traditionally been very keen on incentivising is getting its citizens saving enough for retirement. The way this has historically been done is to allow income tax relief on the proportion of an employee’s gross salary which is put into a pension. i.e. If you earn £30,000 and put £5,000 of that into a pension, then you pay no tax on the £5,000 and are then taxed as if you only earn £25,000. You might think to yourself great, so now people are saving more for their retirement and everyone lives happily ever after, the end. Well not quite. The problem with this arrangement is certain unscrupulous individuals started to use this mechanism to avoid paying tax. Let’s say you’re 64, quite well off, and hoping to retire next year, why not chuck most of your money into your pension? You can live off your savings for a year and then all that money you would have taken as income and therefore been taxed on can instead be deferred for a year, taken as pension when you retire, and you would pay no income tax on that year's salary. Or let’s suppose an individual come from a very wealthy family, and doesn't really need to get paid a salary to live on, then they could just put their entire salary into a pension, not take anything until they retire (at 55), and then not pay any tax at all on their earnings from their job across their entire career. Okay, fine, it sounds like we’re going to need some caps on the maximum pension tax relief to stop people doing this. Let’s say – £225k per annum is the maximum that can be put into a pension pot per year, and £1.5m is the total size of a pension pot you can build up before we start making people pay tax. That’s a large amount of money, who’s going to complain about that? These were the levels set by Tony Blair’s government between 2004 and 2006. These caps were then slowly increased over time, reaching a height of around £250k pa, and £1.8m as a lifetime allowance in 2011. These are very big figures, and it’s hard to imagine anyone objecting to a tax on an annual pension contribution above £250k. In 2011, with a rapidly expanding budget deficit to deal with and a promise to balance the books, the Conservative government instigated their infamous austerity programme. The tories had pledged to ring-fence certain areas of government spending (the NHS, and Education for example), they therefore started to look around for other areas to raise additional income which had not traditionally been taped. Tax relief for high earners seemed like an obvious target, and who can really say that the rich should not have to pay additional tax given the situation to help try to protect spending on areas such as policing or social care. By 2014 the annual allowance (the amount that can be saved per annum) had been reduced to £40k per annum, and the lifetime allowance was down to £1m. These values still seem high, however with the economy in the state it was, they are perhaps not as high as they first appear. This reduction came during a period of all-time low interest rates, I'm going to demonstrate which this caused issued by examining a series of graphs. The following graph displays the Bank of England base rate for the last twenty years, notice the significant reduction in 2007 following the global financial crisis. Note we have been at this very low level ever since. As a proxy for the investment return a pension or life insurance company could receive on a long term almost risk-free investment I’m going to use Base rate + 2%, I've plotted this as well on the graph below: Okay, so why is this important? The interesting idea is that the ‘price’ of an annuity can be approximated using quite a simple formula. It is (very) roughly equal to: $ A = \frac{1}{i} $ Where i is our investment return. What does this mean in real numbers? If I want to retire and get a pension of £10,000 per annum, Then the price of that is going to be 10,000 * A = 10,000 / i. If i=10%, then I will need to have a pot of £100,000. If i = 1%, then I will need a pot of £1m. Let’s plot the implied annuity price on the same chart as a secondary axis: So we see we have this reciprocal relationship, as interest rates go down, the cost of an annuity goes up. At the moment, due to the very low interest rates, it costs something like £37 to purchase an annuity of £1 per annum for life. Interesting you might (or might not) think. But this annuity price becomes useful if we combine it with the lifetime tax-free allowance. If we assume a potential retiree is going to use their pension pot to purchase an annuity, then to calculate the level of pension they will be able to get, we need to take their pension pot and divide by the cost of the annuity. The graph below shows the approximate tax-free pension one could expect if retiring with a pension pot equal to the full Lifetime allowance, using the prevailing annuity rates which are in turn based on the prevailing interest rates. So we see that through a combination of the LTA being reduced significantly and interest rates bottoming out, we are now in the position where the maximum tax-free pension (based on approximate annuity rates) is as little as £25k. A far cry from the approximately £100k when the rule was first implemented. What about that burning social injustice you mentioned? But at least we are all treated the same right? Well not exactly… all of the above glossed over one quite important point, it assumes that the individual in question has a defined contribution pension. For individuals with a final salary pension (which includes MPs, Judges, a majority of CEOs and senior public sector employees), the LTA is calculated with reference to a fixed annuity factor of 20. Given the actual average annuity price is more like 40, this has a massive impact. Let’s plot this on a graph as well. Hmmm, so we see that in 2006 when the LTA was first set up, this factor of 20 was quite generous to Defined Contribution pension holders, they could often retire with a pension of around £120k without paying any tax, whereas a defined benefit pension holder could only retire with a maximum of approx. £80k. This has now flipped, due to changes in annuity rates, and the fact that this factor has not been adjusted for so long. Under current conditions, the maximum pension that can be taken tax free is around £25k pa for a definied contribution pension, but around £50k pa for a definied benefit pension.

So what is the point of all this? What am I advocating? To me it seems clear that we need (approximate) equality of outcome in terms of taxation for defined contribution pensions compared to defined benefit schemes. This could be achieved in one of two ways, either we apply some sort of floor to how low the tax free pension can reduced to for defined contribution pensions, or we adjust the defined benefit annuity factor periodically to keep it roughly in line with market conditions and therefore apply a lower maximum tax free rate to defined benefit pensioners. This would correct the current system by which judges and MPs (and other people with DB pensions) get significant tax breaks at retirement compared to individuals with DC pensions. |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed