|

I finally got around to reading through the 'Curriculum 2019' announcement the Institute made last year. Over the last couple of years, the Institute has carried out a comprehensive review of the qualification process. Based on this they then launched a new curriculum, called Curriculum 2019, which is due to be phased in over the next two years. Some of the changes seem positive, but there's still some fundamental issues that I have with the exams, I thought this would be a good time to write about them. First let's look at the new exams: CS 1 - Actuarial Statistics CS1 looks to be largely just CT3 with a little bit of CT6. The weighting of the subsections for Cs1 will be:

My only comments on this would be that I've seen Regression models used in practice only once while I've been working. It does seem more common to use them in econometric models, and to a lesser extent they do seem to be used in banking/investments environment but on the whole I'm not sure how relevant they are to the work carried out by most actuaries. It could be argued that Regression Models are a useful precursor to the much more powerful and widely used Generalised Linear Model, but I'm not sure it warrants a 30% weighting here. Other than that, this module looks sensible. CS 2 - Actuarial Statistics CS2 is mainly based on the old CT4, and also has some of the CT6 topics which were not included in CS1. The subsections are:

The big point to note here is the inclusion of Machine Learning for the first time in the actuarial exams, I think this is a long overdue and much needed addition. My only criticism would be that it has not been given a greater weighting in the curriculum. I think the advances in Machine Learning, and the fact that most actuaries are not keeping abreast of the subject, is the biggest threat to actuaries remaining relevant within the larger analytics space. The danger is that actuaries will be increasingly sidelined over practitioners with backgrounds in Data Science and Artificial Intelligence. I would have argued for creating an entire module based on the advances in Data Science which I would have made entirely computer based with a focus on the practical application of the models. In order to make room for an increased focus on Data Science, I would have reduced the time spent on Time Series and Survival Models in this module. Time Series, like Regression Models, are not that widely used in practice as far as I'm aware, with their main uses being limited to econometric models, and to a lesser extent in investment models. This part of the curriculum in my opinion could be moved to the Specialist exams section where relevant without much loss. Likewise for survival models, which outside of life and pensions do not have wider application. CM1 - Actuarial Mathematics CM1 looks like it is mainly based on CT1 and CT5. The subsections are:

The invention of Decrement Models and Life Tables in the 17th century marks the beginning of Actuarial Science as a separate field of study. For this historical reason alone, I don't think there's much chance of them being dropped from the curriculum. Personally I've never liked them, finding them messy, and the calculations fiddly and time consuming. Given the fact that they are not used outside of pensions and Life Insurance I would definitely not complain if they were removed from the Core Principles part of the exams and moved into the Specialist Principles section instead. I think I would definitely recommend to new Actuarial Students that they start with the CS exams or the CB exams before tackling the CM exams. The CM exams, while containing some useful topics, seem on the whole less relevant and less interesting than the material covered in the other exams. If a student came from a STEM background I would probably recommend they start with the CS exams, and if they came from a Economics/Management background I think I would recommend that they start with the CB exams. CM2 - Actuarial Mathematics CM2 is largely based on CT8. The subsections and weightings are:

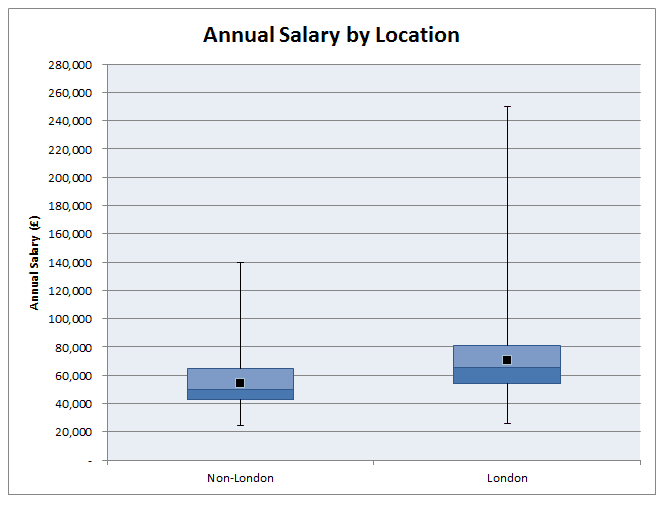

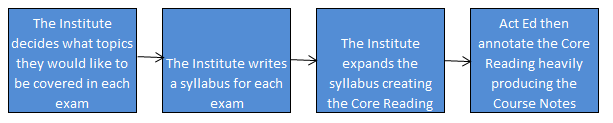

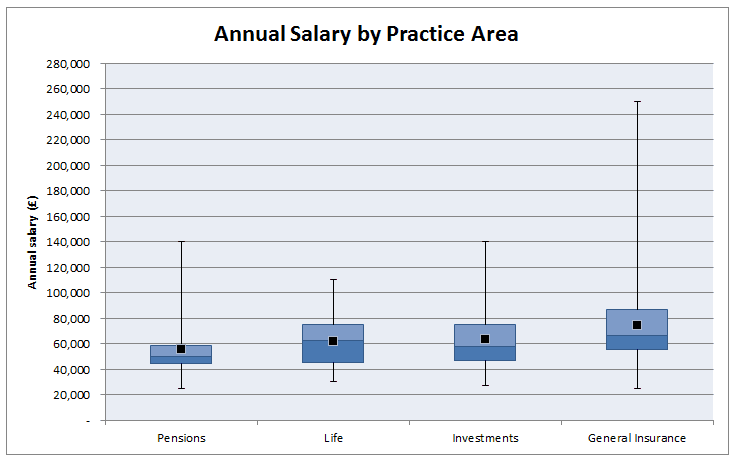

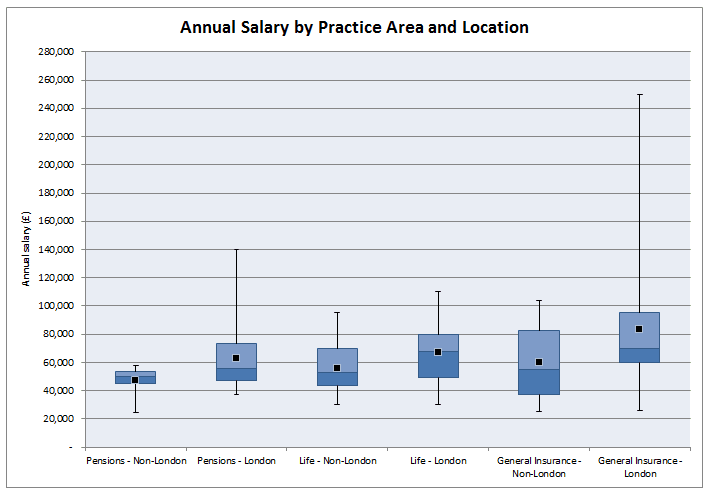

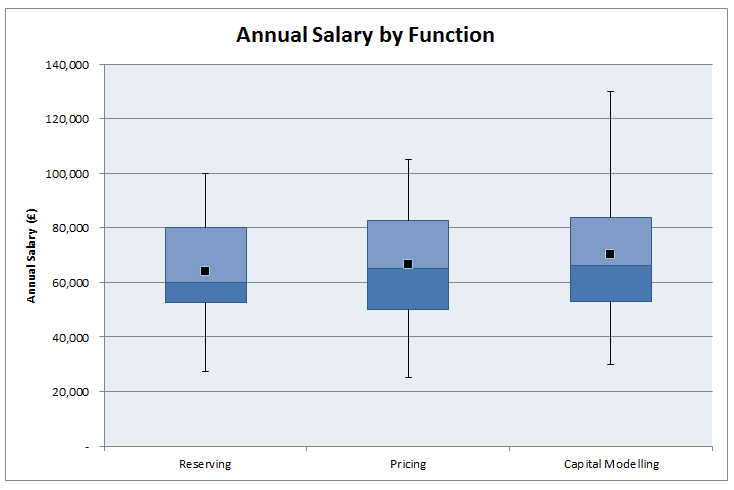

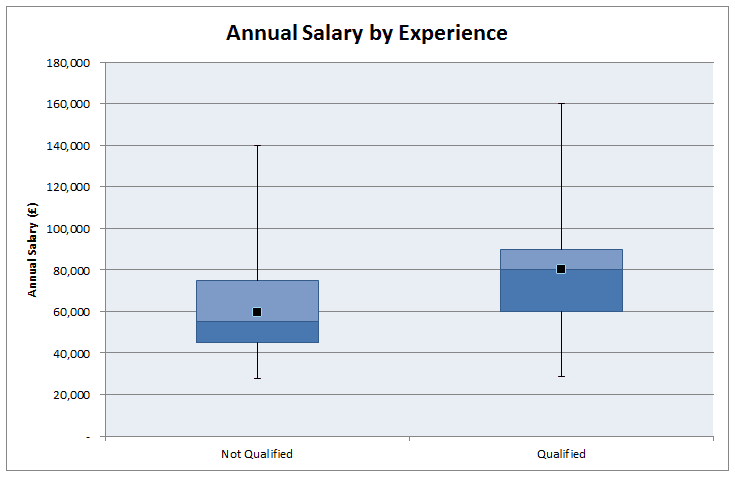

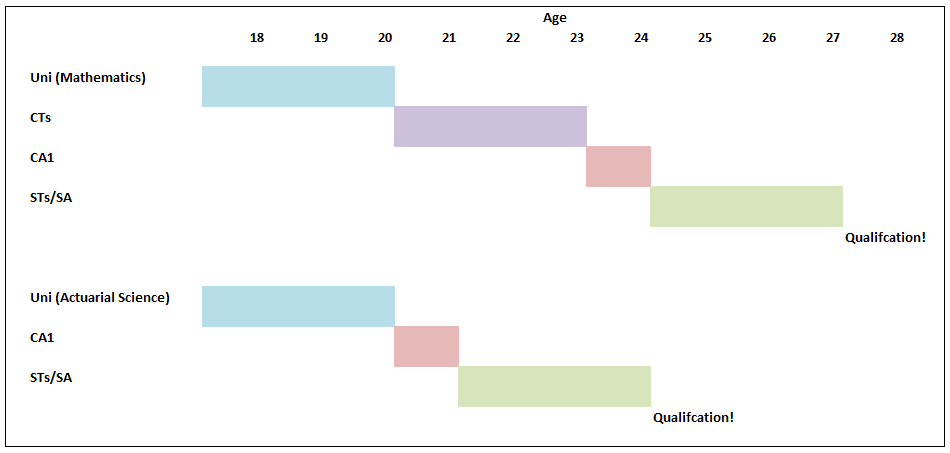

CT8 is a tricky exam to judge, I personally enjoyed studying it, yet I'm once again not sure how useful a lot of the material is. Actuaries have often been accused rightly or wrongly of being out of touch with developments in related branches, and I think this was true of the advances in Financial Mathematics 20 years ago. Historically Financial Mathematics had an independent development to Actuarial Science, and for a long time the advances in Financial Mathematics, such as the Captial Asset Pricing Model (CAPM), or the Black Scholes Option Pricing Model, were largely ignored by the Actuarial Profession. An attempt was made to correct for this, and the CT8 module was invented. The issue now is though, that CT8 still has a relatively high weighting in the exams as a whole. Returning to my point about Machine Learning, the Institute has given Option Pricing (an obscure part of investment theory) twice the weighting of the entire subject of Machine Learning! The second worry I have about the CM2 syllabus is that since the Financial Crisis, Financial Mathematics has advanced considerably, with some topics falling out of favour (one such example being the Black-Scholes Option Pricing Model) and other topics have gained favour, yet the syllabus does not seem to have changed in line with these developments. The other exams in Curriculum 2019 are basically one to one replacements of current exams, so I won't go through them in detail. I will mention a few broader changes that I would make to the Institute's education policy. 3 Recommendations for a new Curriculum When I was thinking about what I would change about the course notes I had quite a few ideas - include a module on coding, specialise earlier so that GI actuaries don't need to learn about with-profit life insurance contracts, Life Actuaries don't need to learn about the CAPM etc., expand the communications section of the exams (this one in particular would not be popular..), but other than the three I've written about below, all my ideas had pros and cons and I think I could be talked out of them. The three I mention below though though I think have really compelling arguments. Recommendation 1 - Rewrite the Course Notes with the aim of making the subject as easy to understand as possible The process for creating the course notes at the moment is quite convoluted: Three main problems stand out for me with this process. Firstly, when Act Ed receive the Core Reading, they are unable to change the ordering of the material. This has the unfortunate effect that often the material is not presented in the order which would make it the easiest to understand.. Material is instead introduced in the the order in which it was included as an item in the syllabus. This quite often necessitates flicking back and forward between pages and not understanding one section until you have read and understood a later section. The second problem with the current process is that by providing an annotated version of the Core Reading, rather than writing the Core Reading in a manner which could be understood without annotation in the first place, we end up with this strange hybrid style which can be a significant barrier to understanding the material. The Core Reading produced by the Institute is often terse, can be inconsistent, and is not always friendly to the reader. The annotations are often well written and help to clarify the unclear sections, but why add the extra cognitive load? Just get someone like Act Ed involved at an earlier stage and write something that is coherent and easy to understand in the first place. The third problem is that there is no single person taking responsibility for the finished product. For an Institution that prides itself on it's approach to accountability I think this is unfortunate. By giving someone with the relevant experience and skills overall creative and technical control over the finished product I believe we would end up with a much more polished and accessible finished product. The syllabus appears to be written by committee, and the Core Reading then expanded out with an awareness that clarifications will be made later. While I think Act Ed do a great job of turning this into something understandable, they are at this point constrained by the presentation of the Core Reading, I think a better product overall could be made by changing this process. Due to the above three issues, when studying for the CT exams I would normally not read the Institute Course Notes at all until just before the exam, instead relying on Course Notes (published online for free!) from uni modules that covered the same material. Due to the exemption system, I found that I could often find modules which covered precisely the same material, but the notes would be written by a university lecturer with a deep understanding of the subject, and also experience of writing notes which are meant to be understood. Whenever I did this, I found the uni notes much easy to work from. Recommendation 2 - Make all the material available online for free. The Course Notes for the actuarial exams are really expensive. This basically restricts the people who are able to study the notes to those who are employed in an actuarial role, and who's employer is willing to fund them in sitting the exams. Given the professions's public charter of "in the public interest, to advance all matters relevant to actuarial science and its application and to regulate and promote the actuarial profession" I think this would be a great idea, as opening up the material to anyone who would be interested in reading them would massively increase the number of people reading the notes. This would particularly lower the barrier for prospective students from poorer backgrounds or countries where the costs would otherwise be prohibitive. To me it's a no-brainer that you should try to reduce the barriers to education as much as possible. Providing free access to allow anyone to study actuarial science is a net public positive with very little downside. There would not be a significant cost in the Institute hosting the e-books on the website for people to download given the web infrastructure is already there. But there would be a significant loss of income. Looking at the Institute's financial accounts for 2016/2017 the total income relating to 'pre qualification and learning development' was around £10 million, the proportion of this which is made up of income related to selling the Course Notes is not specified, but my very rough guess would be that it might be somewhere around a quarter of the total, so £2.5 million. This estimate is just based on the relative cost of the Core Reading (in the range of £50 - 100 for most exams), and the cost of entering the exams (in the range of £220 - £300 for most exams). This would represent around 10% of the Institute's total income, which is significant, but would not be impossible to offset against increases in other areas. Recommendation 3 - move away from written Course Notes to Online Videos Imagine instead of having to read through the Course Notes in order to understand the material, you were instead given one to one private lectures with one of the top educators in the entire country for the six months leading up to the exam. You are allowed to have the lectures at any time of the day, if you prefer mornings you can have them in the morning, if you prefer learning at 2 AM whilst listening to Kerry Perry on full blast then the lectures can be adjusted accordingly. You can repeat any particular lecture as many times as you like, and ask the lecturer to pause half way through a lecture while you think about something. The lecturer is also on top form each lecture, they are giving the best version of that lecture that they have ever given. When you put it like that it sounds pretty good! I think some version of Massive Online Open Courses (MOOCs) or Khan Academy style videos are the future of education. The best metaphor I heard someone use to explain them is if you think back 200 years, if someone had wanted to write the Dark Knight, then Christopher Nolan would have still written the same amazing script, but rather than watching Christian Bale and Heath Ledger (two of the best actors in the world) star in a production which cost 185 million USD to make, you would have had to go to your local theatre and watch the best two actors in your village do their best take on Nolan's script. The budget would have been a fraction of 185 million, and if the actors were having a bad day, or forgot their lines, then they would have had to muddle through. Bale and Ledger had the opportunity of doing take after take until they came up with the perfect version that they were happy with. The video was then post processed and sharpened for months, before being shown to test audience and then further refined based on their feedback. The Institute could be producing 'Hollywood style' videos right now as a compliment to the Course Notes. Which areas of actuarial work are the best paid? Salary estimates for actuarial work are pretty hard to come by and in my experience not particularly accurate, Also, in practice there are also large differences in salary when accounting for experience, practice area, function, and location. So I thought I'd try to put together my own analysis which accounts for all these variables! As a source of data I decided to work from online Job Adverts, mainly because I can collect them with a minimum of effort, but also because the only other option would be to send out my own survey (and to be honest why would anyone complete a salary survey from a random guy online?). Step 1. Collect Some Data I started by web scraping about 800 job adverts from an actuarial job site. This was all the job which were listed on the website at the time. Since this might be 'slightly' (i.e. completely) against the terms of service of the site, I won't say which site the adverts are from or publish any of the raw data. I don't see any issues with publishing aggregated data from the website though. Once I had scraped the adverts, I extracted the salary figures and discarded adverts that did not include a salary, this left about 350 job advert to work with. Step 2. Analysis My first step was to segment the adverts by practice area. Rather than going through each advert one at a time, I split them by looking at key words in the adverts, for example, adverts containing the terms 'pensions', 'employee benefits', or 'defined contribution' were all assigned to the category 'Pensions'. These figures were then used to produce the following box and whiskers chart: As expected, General Insurance comes out as the highest paid practice area with Life and Investments in joint second place and Pensions lagging quite a bit behind. In case you can't remember how a box and whiskers chart works, the black dot is the mean, the three lines in the box represent the 1st quartile, median, and 3rd quartile, and the whiskers go up to the maximum and down to the minimum value. Are there any other correlations that are affecting this ranking though? Since a lot of GI jobs are based in London, does London's higher average salary accounts for the difference? First let's check that actuarial jobs in London do actually have higher salaries than actuarial jobs outside London.  As expected, London based jobs are clearly better paid on average than non-London based jobs. In order to see whether location is driving the differences between salaries across practice areas we need to include location as another variable in our chart: This chart gets a bit more messy, but we can see that even when we account for the effect of location, we still have the same ordering of practice area: General Insurance > Life > Pensions Now that we've looked at practice areas, I'm going to show my bias towards insurance and look at the effect of the type of actuarial work within an insurance company on salary. Surprisingly, all the functions are relatively equal. There seems to be a weak ordering of: Capital Modelling > Pricing > Reserving Though the difference does not seem to be significant. Finally, let's look at the effect of qualifying on salary. As expected, jobs for qualified actuaries have a mean of £20,000 higher than part/nearly qualified positions. All the more reason I should be studying right now rather than procrastinating on here!. Actuarial Science vs Mathematics24/12/2016 Let's suppose you've decided that ultimately an actuarial career is the career for you. You've heard that it's well paid, low stress, and offers a great work-life balance. If this is the case, you'd be crazy to study anything but Actuarial Science at University right? Well kind of... Naturally, no discussion of whether to study Maths, Actuarial Science, or Finance would be complete without one of my favourite charts (for some reason I really like the name), a Gantt Chart, so here is one showing an example of how long it might take a student to qualify if they studied Actuarial Science or Mathematics. Exemptions! Why is the actuarial science path so much shorter? Most 3 year actuarial science courses will give you the opportunity to gain exemptions from the first 8 CTs. It's the reason that in the chart above actuarial science is so much quicker to qualify, and it's one of the main reasons that people decide to study actuarial science at uni. So are there any downsides to getting all these exemptions? Oh, you just got exemptions? I did it the hard way... Qualifying through exemptions is definitely quicker than qualifying through the institute exams so expect some sour grapes from people who did it 'the hard way'. There is also a perception that an equivalent exam at uni is easier than an IFoA exam. It's hard to judge this, but I have memories of doing very little work for some uni modules during most of the year, then cramming for a couple of days before the exam and then scraping a pass. Good luck doing this with the institute exams! So expect in your career for someone who studied the institute exams to be seen as marginally more accomplished than someone who passed through university exemptions. Is it better to keep your options open? Actuarial Science is also a much more focused degree, it literally has the job title in the subject. On the whole, Mathematics gives a much broader range of possible career paths than Actuarial Science. People who study actuarial science, though not completely locked in to becoming an actuary, are pretty much restricted to a career in finance. Maths grads have a much broader range of careers but can also easily move into finance. So I think that there is an argument for keeping your options open a bit more with a broader degree. Imagine you start Actuarial Science at 18 and then decide that you hate finance? Also, you need to ask yourself what you want to get out of your university education. There are two main schools of thought as to the purpose of a university education . The liberal arts school of thought, more prevalent in US universities, has students studying a wide range of topics with the goal of producing a well rounded graduate, able to step up and fully participate in civic life. The European model places more emphasis on vocational study, with a university degree being seen as preparation for a career. Actuarial Science is definitely on the vocational side of the spectrum, whereas I would say that Mathematics is more on the liberal arts side of the spectrum. (This might sound questionable, how can a Mathematics degree be considered a Liberal Art? But remember that the goal of most mathematics degrees is to teach you to think 'like a mathematician' it's widely acknowledge that you will never use 99% of the actual mathematics that you studied) That's also not to say that actuarial science degrees will focus only on 'actuarial' topics, most will cover the full range of finance, business and economics and in some respects are broader than a mathematics education. But for me it's the fact that you are studying as preparation for a specific job rather than studying general skills that makes actuarial science more vocational. It's not what you know it's who you know... I think one strong point in favour of actuarial science which I haven't seen discussed much is that actuarial science grads seem to make much better connections and have more recruitment opportunities than less vocational degrees. Most of my friends who studied mathematics are spread through various industries and various countries. Whereas most connections made through an actuarial science degree will end up working in the same industry as you, focused around the same few cities. If nothing else it gives you more people to meet for drinks at lunch under the guise of 'networking'. Some more random thoughts.

I'm currently studying for the IFoA ST7 - General Insurance: Reserving and Capital Modelling exam which I will be sitting in a couple of weeks time, I know, you're all jealous of what a great time I must be having right now.

The Institute publishes past papers on their website with specimen solutions which is really helpful, what is less helpful though are the comments that the Institute's examiner has decided to sprinkle through out the specimen exam solutions. I've collected some of the better ones: “many candidates seemed to have an incredibly superficial understanding of key concepts which fell over when they were asked to apply those concepts” “There were almost no reasonable answers to this part.” “Very poorly answered. Most candidates made only one or two points and these were often confused.” "Overall candidates displayed remarkable innovation in the range of ways in which they managed to get this question wrong." “Almost nobody made a reasonable attempt at this part.” “many candidates struggled with the mitigation question, displaying an excessive tendency to focus on cover changes that would clearly be at best inappropriate and at worst illegal for compulsory covers; these candidates were fortunate that the marking system does not allow negative marks to be given.” “A fairly straightforward calculation which very few got right.” It makes me warm and fuzzy to know that how highly the examiner thinks of us students. Taking the last comment as an example - is it perhaps evidence that the calculation is not in fact 'fairly straightforward' given 'very few got it right'? |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed