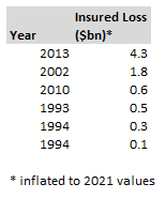

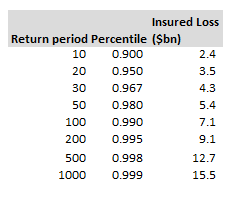

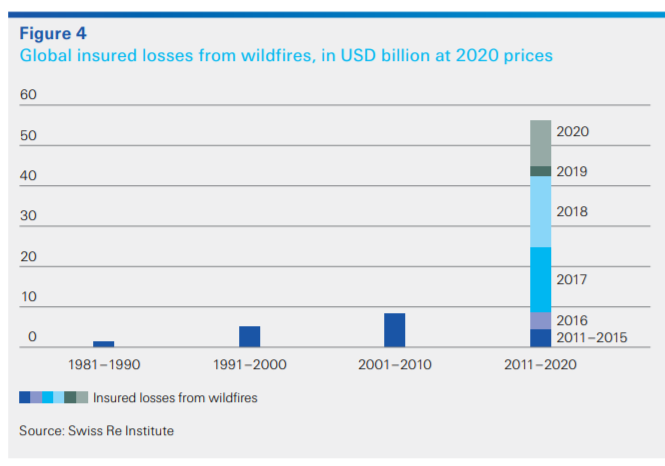

German Flooding - tail position23/7/2021 As I’m sure you are aware July 2021 saw some of the worst flooding in Germany in living memory. Die Welt currently has the death toll for Germany at 166 [1]. Obviously this is a very sad time for Germany, but one aspect of the reporting that caught my attention was how much emphasis was placed on climate change when reporting on the floods. For example, the BBC [2], the Guardian [3], and even the Telegraph [4] all bring up the role that climate change played in the contributing to the severity of the flooding. The question that came to my mind, is can we really infer the presence of climate change just from this one event? The flooding has been described as a ‘1-in-100 year event’ [5], but does this bear out when we analyse the data, and how strong evidence is this of the presence of climate change? Image - https://unsplash.com/@kurokami04 Percentile modelling In order to start to answer this question let’s look at some historic German floods. I’m going to use the total insured loss as my severity metric, as I can easily source this from Swiss Re’s Sigma Explorer [6]: The table below has the top floods in Germany over the last 30 years We can see that the worst flooding from an insured loss perspective in the last 30 years was the 2013 flooding which lead to \$4.3bn of insured loss (when adjusted for inflation to 2021 values), the second worst was 2002 with \$1.8bn, which drops off quite sharply to 2010 with a \$0.6bn loss. Let’s build a basic Poisson/Lognormal model around these events. Our Poisson freq will be events xs \$100m (the lowest value in our table, which occurs at a rate of 6 in 30 years, i.e. 1 in 5 years), the average severity of such events (xs \$100m) = 1.3bn, and the standard deviation of losses xs \$100m = \$1.5bn. We can then take these parameters and simulate 25k years of events. This produces the following OEP table: Just to sense check the fit of the curve – our 1-in-30 return period is modelling at \$4.3bn, vs the empirical of \$4.3bn (2013 @ \$4.3bn was the worst year out of the 30 in our dataset), so the model appears to be giving a sensible value against the most extreme point of our dataset. We’re pretty blind outside the range of historic losses, but our 1-in-1,000 year event is modelling at \$15.5bn, which possibly seems a bit light to me just based on gut feel, but let’s just leave it be for now. Estimates for the 2021 event It’s still early to put a reliable number on the insured loss from the 2021 floods, but the Insurance Insider quotes an anonymous underwriting source who puts the value at ~\$6bn [7]. As an aside, in the Insider article under historic German floods, they list an event in August 2020 @ \$3.4bn, I think this is an error and they have accidently included the August 2002 Czech insured loss (of \$3.4bn). For some reason Sigma Explorer places the event in Czechia on the map but then calls it a ‘German event’. I can only think the 2002->2020 is a typo. We all make mistakes, so don’t believe everything you read, I’m glad I checked back to the original Swiss Re figures! Positioning this \$6bn loss against our Poisson/Lognormal model suggests the 2021 Germany flooding is a 1-in-65 year event. i.e. based on past history, we should expect an event equal or greater in severity approximately once every 65 years. I calculated this directly from my 25k sims, but we can also read it off approximately from the table above by noting that \$6bn sits between the \$5.6bn of the 1 in 50 and the \$7.1bn of the 1 in 100. Climate Change? Let’s return to our original question – is this strong evidence of climate change? I’d say it’s fairly strong evidence of climate change, but hardly a slam dunk. On the one hand, 1-in-65 year events are hardly black swans, they do happen, (in fact on average they happen once every 65 years so maybe once in a lifetime). Just because it happened to us this year should not be seen as incredibly unlikely. To take this single event as clear evidence that structurally something must have changed in the climate in order for an event of this magnitude to occur would for me be pushing the boundaries of our evidence. Had we had a 1-in-500 year event, or a 1-in-1000 year event (in the range \$12bn-\$15bn), this would be much clearer evidence that we had a significant shift in event severity. On the other hand, I think there is something to be said for the fact that in the last 10 years, we’ve now had both the costliest (2021 @ \$6bn), and second costliest (2013 @ \$4.3bn) flood events in Germany on record. If these were just random events, then both occurring within the last 10 years of each other would be extremely unlikely. This for me is stronger evidence of climate change having an effect rather than anything we can infer from the single 2021 event on its own. If we stripped out the 2021 and 2013 events from our loss data and refit the Poisson/Lognormal, then I suspect both events would be much further out in the tail than a 1-in-65 year event. I think it’s also appropriate to combine the evidence of this event being driven by climate change with more general evidence globally of climate change increasing the frequency of extreme weather events. For example, how about the following graph of wildfire losses (there’s some minor(!?) clustering in the last 10 years) [8]: From this chart, I would infer that the idea that climate change is leading to more severe insured losses, is a hypothesis which already has some evidence behind it.

So in conclusion, the severity of this event is consistent with climate change having an impact on the frequency of extreme weather events, and it’s a story we’re seeing globally. However I’d probably stop short of saying this event is so extreme that it can only be explained by this hypothesis. (To state things as a good Bayesian, that means it would count as evidence for the hypothesis.) Caveats Just to pre-empt a few criticisms of my fairly basic model, here are a number of ways it could be refined:

Also, the analysis is dependent on the \$6bn figure being reasonably accurate. If the final figure were 50% lower (\$4bn), we’d be talking about a 1-in-25 year event, and if it were 50% higher (\$9bn), we’d be talking about a 1-in-200 year event. So our modelling is fairly sensitive to this assumption. [1] www.welt.de/vermischtes/article232577293/Hochwasser-Mindestens-166-Tote-in-NRW-Rheinland-Pfalz-und-Bayern.html [2] https://www.bbc.co.uk/news/world-europe-57880729 [3]https://www.theguardian.com/commentisfree/2021/jul/19/the-guardian-view-on-germanys-floods-another-wake-up-call [4]https://www.telegraph.co.uk/world-news/2021/07/16/80-dead-thousand-still-missing-flooded-german-towns-ruins/ [5] www.washingtonpost.com/world/2021/07/16/europe-flooding-deaths-germany-belgium/ [6] https://www.sigma-explorer.com/ [7]https://www.insuranceinsider.com/article/28t9zr9l3ja4su9fcaxhc/reinsurers-braced-for-eur5bn-loss-from-historic-german-flood-event [8] www.swissre.com/institute/research/sigma-research/sigma-2021-01.html |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Leave a Reply.