|

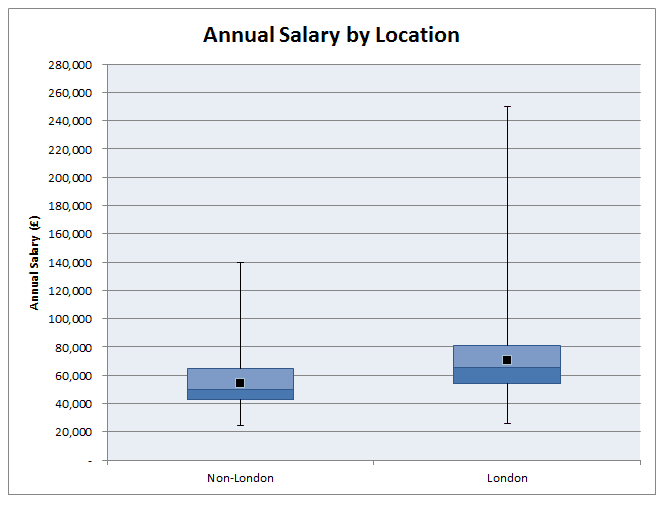

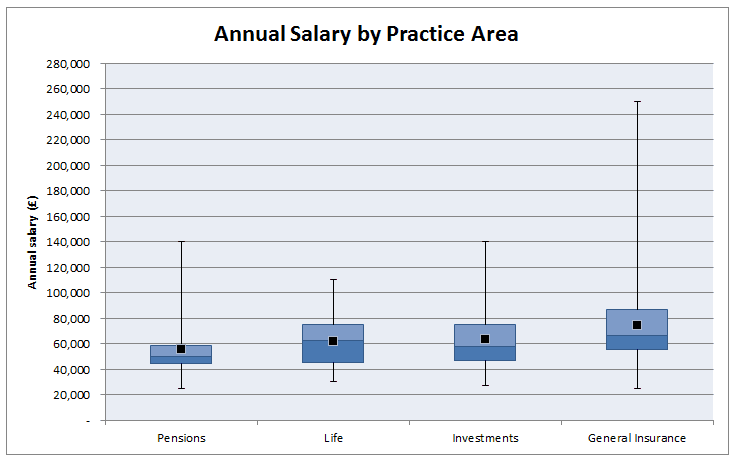

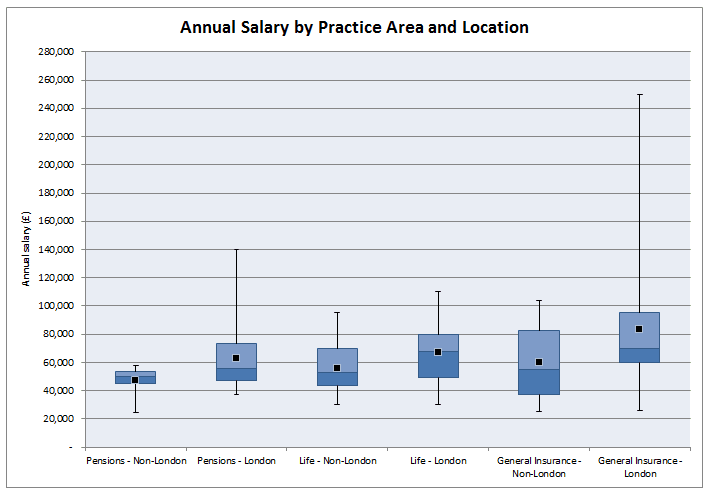

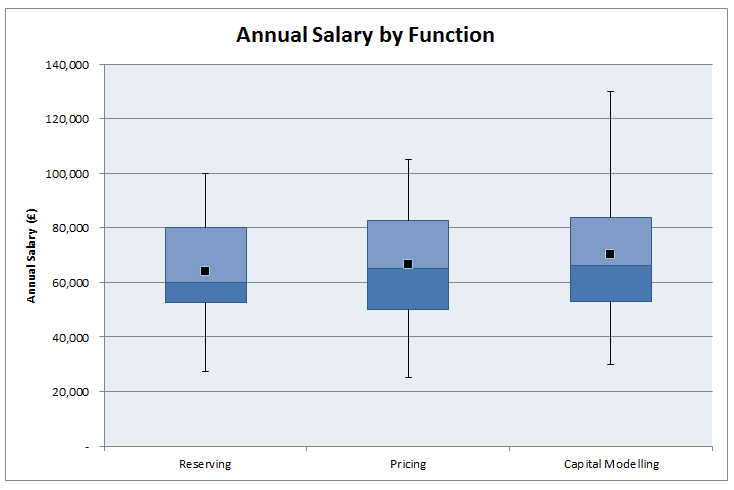

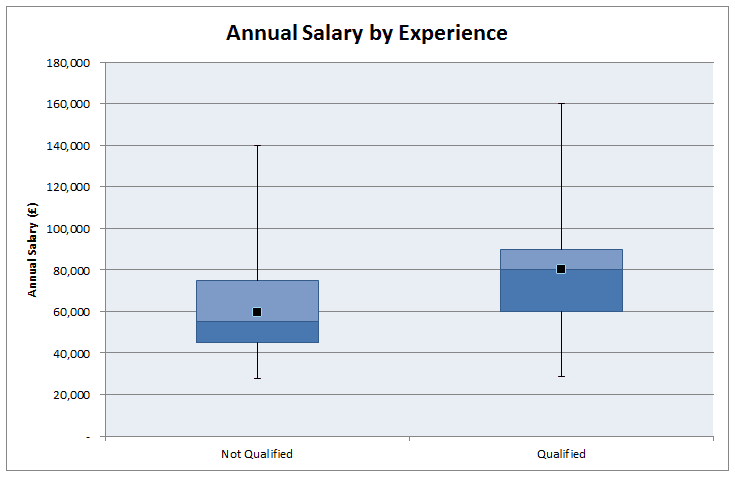

Which areas of actuarial work are the best paid? Salary estimates for actuarial work are pretty hard to come by and in my experience not particularly accurate, Also, in practice there are also large differences in salary when accounting for experience, practice area, function, and location. So I thought I'd try to put together my own analysis which accounts for all these variables! As a source of data I decided to work from online Job Adverts, mainly because I can collect them with a minimum of effort, but also because the only other option would be to send out my own survey (and to be honest why would anyone complete a salary survey from a random guy online?). Step 1. Collect Some Data I started by web scraping about 800 job adverts from an actuarial job site. This was all the job which were listed on the website at the time. Since this might be 'slightly' (i.e. completely) against the terms of service of the site, I won't say which site the adverts are from or publish any of the raw data. I don't see any issues with publishing aggregated data from the website though. Once I had scraped the adverts, I extracted the salary figures and discarded adverts that did not include a salary, this left about 350 job advert to work with. Step 2. Analysis My first step was to segment the adverts by practice area. Rather than going through each advert one at a time, I split them by looking at key words in the adverts, for example, adverts containing the terms 'pensions', 'employee benefits', or 'defined contribution' were all assigned to the category 'Pensions'. These figures were then used to produce the following box and whiskers chart: As expected, General Insurance comes out as the highest paid practice area with Life and Investments in joint second place and Pensions lagging quite a bit behind. In case you can't remember how a box and whiskers chart works, the black dot is the mean, the three lines in the box represent the 1st quartile, median, and 3rd quartile, and the whiskers go up to the maximum and down to the minimum value. Are there any other correlations that are affecting this ranking though? Since a lot of GI jobs are based in London, does London's higher average salary accounts for the difference? First let's check that actuarial jobs in London do actually have higher salaries than actuarial jobs outside London.  As expected, London based jobs are clearly better paid on average than non-London based jobs. In order to see whether location is driving the differences between salaries across practice areas we need to include location as another variable in our chart: This chart gets a bit more messy, but we can see that even when we account for the effect of location, we still have the same ordering of practice area: General Insurance > Life > Pensions Now that we've looked at practice areas, I'm going to show my bias towards insurance and look at the effect of the type of actuarial work within an insurance company on salary. Surprisingly, all the functions are relatively equal. There seems to be a weak ordering of: Capital Modelling > Pricing > Reserving Though the difference does not seem to be significant. Finally, let's look at the effect of qualifying on salary. As expected, jobs for qualified actuaries have a mean of £20,000 higher than part/nearly qualified positions. All the more reason I should be studying right now rather than procrastinating on here!. |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Thanks for putting this presentation together, this was really interesting.

Leave a Reply.