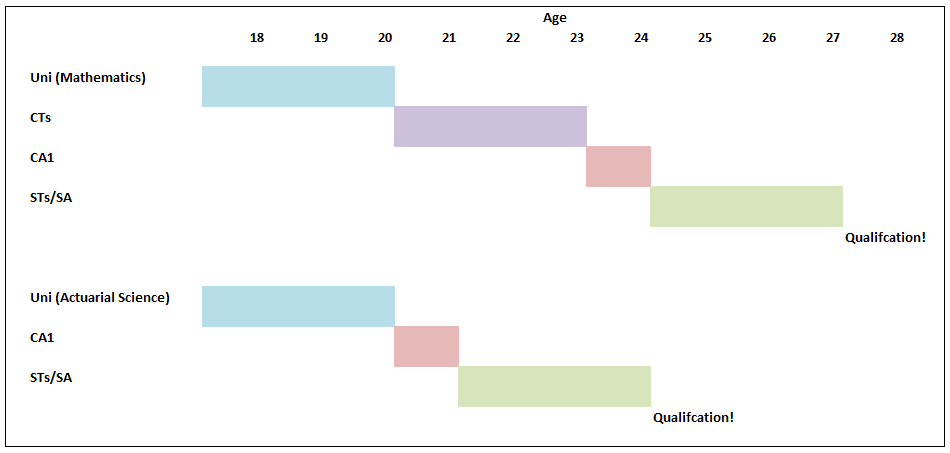

Actuarial Science vs Mathematics24/12/2016 Let's suppose you've decided that ultimately an actuarial career is the career for you. You've heard that it's well paid, low stress, and offers a great work-life balance. If this is the case, you'd be crazy to study anything but Actuarial Science at University right? Well kind of... Naturally, no discussion of whether to study Maths, Actuarial Science, or Finance would be complete without one of my favourite charts (for some reason I really like the name), a Gantt Chart, so here is one showing an example of how long it might take a student to qualify if they studied Actuarial Science or Mathematics. Exemptions! Why is the actuarial science path so much shorter? Most 3 year actuarial science courses will give you the opportunity to gain exemptions from the first 8 CTs. It's the reason that in the chart above actuarial science is so much quicker to qualify, and it's one of the main reasons that people decide to study actuarial science at uni. So are there any downsides to getting all these exemptions? Oh, you just got exemptions? I did it the hard way... Qualifying through exemptions is definitely quicker than qualifying through the institute exams so expect some sour grapes from people who did it 'the hard way'. There is also a perception that an equivalent exam at uni is easier than an IFoA exam. It's hard to judge this, but I have memories of doing very little work for some uni modules during most of the year, then cramming for a couple of days before the exam and then scraping a pass. Good luck doing this with the institute exams! So expect in your career for someone who studied the institute exams to be seen as marginally more accomplished than someone who passed through university exemptions. Is it better to keep your options open? Actuarial Science is also a much more focused degree, it literally has the job title in the subject. On the whole, Mathematics gives a much broader range of possible career paths than Actuarial Science. People who study actuarial science, though not completely locked in to becoming an actuary, are pretty much restricted to a career in finance. Maths grads have a much broader range of careers but can also easily move into finance. So I think that there is an argument for keeping your options open a bit more with a broader degree. Imagine you start Actuarial Science at 18 and then decide that you hate finance? Also, you need to ask yourself what you want to get out of your university education. There are two main schools of thought as to the purpose of a university education . The liberal arts school of thought, more prevalent in US universities, has students studying a wide range of topics with the goal of producing a well rounded graduate, able to step up and fully participate in civic life. The European model places more emphasis on vocational study, with a university degree being seen as preparation for a career. Actuarial Science is definitely on the vocational side of the spectrum, whereas I would say that Mathematics is more on the liberal arts side of the spectrum. (This might sound questionable, how can a Mathematics degree be considered a Liberal Art? But remember that the goal of most mathematics degrees is to teach you to think 'like a mathematician' it's widely acknowledge that you will never use 99% of the actual mathematics that you studied) That's also not to say that actuarial science degrees will focus only on 'actuarial' topics, most will cover the full range of finance, business and economics and in some respects are broader than a mathematics education. But for me it's the fact that you are studying as preparation for a specific job rather than studying general skills that makes actuarial science more vocational. It's not what you know it's who you know... I think one strong point in favour of actuarial science which I haven't seen discussed much is that actuarial science grads seem to make much better connections and have more recruitment opportunities than less vocational degrees. Most of my friends who studied mathematics are spread through various industries and various countries. Whereas most connections made through an actuarial science degree will end up working in the same industry as you, focused around the same few cities. If nothing else it gives you more people to meet for drinks at lunch under the guise of 'networking'. Some more random thoughts.

|

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Leave a Reply.