|

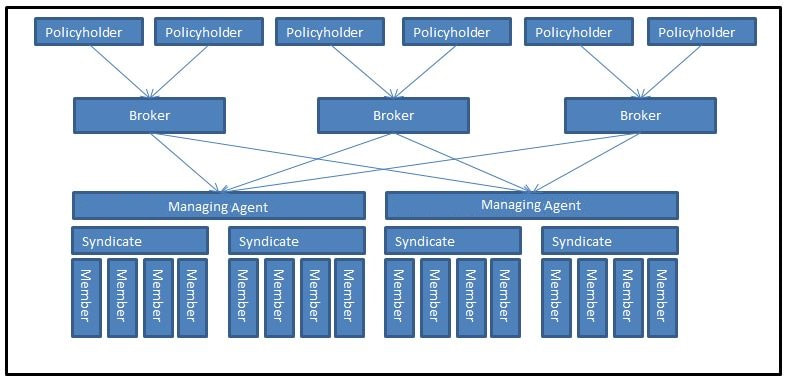

Background Lloyd’s or Lloyd's of London is an insurance marketplace located in the City of London. It developed out of an informal meeting of ship owners, merchants and sailors in Edward Lloyd's coffeehouse. The original coffeehouse first opened in 1688 making Lloyd's over 300 years old. Lloyd's really is a unique and interesting institutional, and there is really nothing else quite like it. For example, did you know that Lloyd's uses an accounting system that runs for thee years rather than the usual one year accounts that most companies use? Three years was the length of time that a 17th century ship took to circumnavigate the globe, and since most of the business written at Lloyd's during it's early years was Marine insurance, it was decided that it was a good idea to run the accounts for three years and it hasn't changed since. But how does Lloyd's work in practice? Who pays whom for what and how do they decide how much to pay? And how do people make money from all of this? Syndicates Syndicates are the basic building blocks of Lloyd's. The word syndicate just means a group of people and in the context of Lloyd's, a Syndicate is a group who are willing to collectively write insurance. Is there a name for the people who make up the Syndicate? Yes there is! They are called Members. The Members join together to form a Syndicate. Members come in many different forms, some will be individual investors, who might have a relatively modest net worth, others will be specialist insurance companies, set up specifically to write business at Lloyd's and worth billions of dollars. The word Member applies equally to both. Members which are set up as companies are called 'Corporate' members, and contribute the majority of the capital at Lloyd's. Individual investors in Lloyd's are called 'Individual Members', or 'Names'. Historically Names made up a majority of the capital, but they are less important now. Even though the Syndicate is the one who provides the insurance to the policyholder, they will not sell the insurance directly to the policyholder, instead a Syndicate will employ a Managing Agent (not to be confused with a Managing General Agent - MGA - which is a separate type of entity) to underwrite the insurance on its behalf. Some Managing Agents will deal with multiple Syndicates and some will deal with just one Syndicate. The Managing Agent will most often arrange the insurance through insurance brokers. That's quite a few different groups, so here's an image showing how they all fit together.

How do Members make money at Lloyd's?

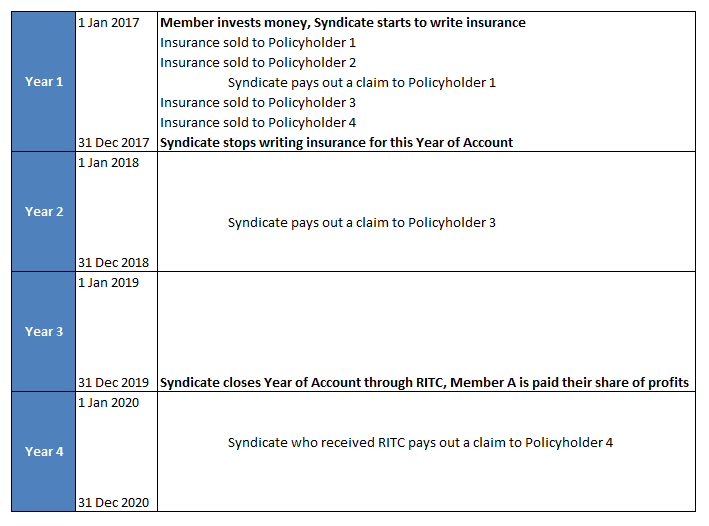

Members agree to write business at Lloyd's for one year at a time. A given year of account will then be kept open for three years. (Remember earlier when we mentioned that this was the length of time it took a 17th century ship to circumnavigate the globe, that's where this number comes from) At the end of the three years, the syndicate will settle up all the outstanding business through a process called Reinsurance to Close (RITC), and then all the profits or losses from all the from all the contracts the Syndicate has written in that year are shared among the members in proportion to the amount of capital they provided to the Syndicate. For example, suppose that in a given year Syndicate A made a profit of £10m and suppose that Member Z provided 2% of the capital that the Syndicate required that year. Then Member Z would receive a payment of £10m * 2% = £200,000. On the other hand, suppose that Syndicate A actually lost £10m over the year, then Member Z would be liable to cover their share of the loss, in this case, £200,000. Therefore all the Members of a Syndicate share in the fortunes of the Syndicate. Here is a graphic with a very simplified example showing a timeline of how this would work in practice.

How do Syndicates get business?

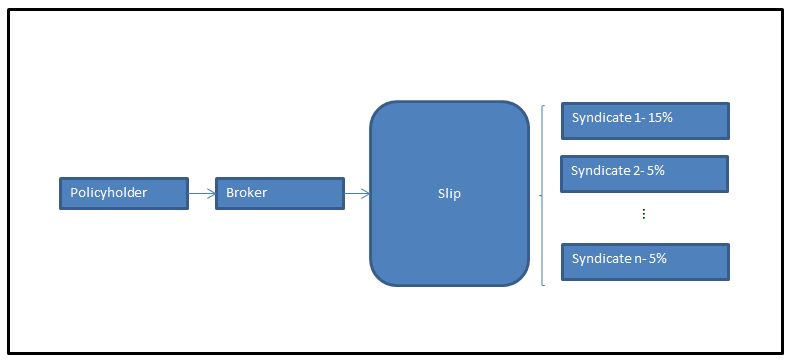

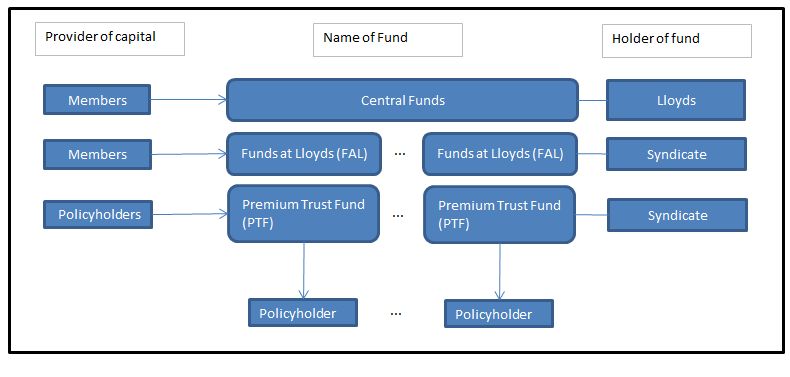

Business at Lloyd's is placed through insurance or reinsurance brokers. A policyholder will approach a broker and ask them to arrange an insurance contract at Lloyd's. The broker will then typically place the contract at Lloyd's through the 'slip system'. Slip System The broker will produce a 'slip' which contains all the details of the risk which is to be insured. For example, a slip might be a contract to insure a large industrial plant from fire damage. Syndicates (through their Managing Agent) may then decide to underwrite a percentage of the slip. What this means in practice is the syndicate will take a percentage of the premium, and then if there is a loss, they will be liable for a percentage of the insurance claim. For example a syndicate might take 5% of the risk. This means that they will receive 5% of the premium that the policyholder pays and be responsible for 5% of the claims arising from the contract if there is fire damage to the industrial plant. The process of spreading the risk around different syndicates is known as coinsurance. As an aside, this is where the term 'Underwriter' originally comes from. When an insurer writes a share of a risk (also known as 'taking a line on the risk'), they will sign their name at the bottom of the slip, along with the % share they are willing to write. Hence the term 'underwriter' - people who write their name under the text of the document. Isn't this unneccssarily complicated though? What's the point of everyone take a share? Why can't one syndicate just take on 100% of the risk? The answer is they can, and sometimes do, particularly for smaller risks. However it will probably be very hard to find a syndicate that is willing to take 100% of a very large risk. Going back to our industrial plant example, if the plant is worth hundreds of millions, the claim size could potentially be in the hundreds of millions too. Let's pause to think about what's going on here then. We saw in the previous section that all the members in a syndicate share the profits and losses from all the contracts that the Syndicate writes in the year, but we now have another type of sharing in the form of coinsurance. So for a given contract we might have a dozen syndicates all sharing the risk, and inside each syndicate we might have dozens of members also sharing the risk of their syndicate. Therefore each contract could potentially be shared by hundreds of members! The following graphic shows how the slip system works. Capital Requirements Any time an insurance contract is written, capital is required to cover the possibility that the claims might be larger than the premiums. Otherwise there is a risk that a policyholder might not be able to claim from the insurer if the insurer gets into financial trouble. Given the complicated way that business is written at Lloyd's, how do we decide how much capital to take from each member, and how is this capital held? The policyholder will pay a premium to the insurer in exchange for the insurer taking on the risk. We saw earlier that this premium will be spread among multiple syndicates depending on which ones sign the slip. Each syndicate will hold the premium it receives from policyholders in a Premium Trust Fund (PTF). The PTF will be a pool of all the premiums that the insurer receives throughout the year, rather than the Syndicate keeping separate funds for each policy written. What happens though if the claims are larger than the premiums across all the business written for the year? The syndicate will run out of money in their PTF and will need additional capital. To cover this possibility members will deposit 'Funds at Lloyd's' (FAL) with their Syndicate. For a given syndicate, if their PTF proves to be inadequate to cover claims, then the syndicate will have made a loss and the FALs will be used to make up the difference. What happens in the unlikely event that even the FALs are too small to cover the claims? To cover this eventuality, all members are also required to contribute a small amount every year to the Lloyd's central fund. This fund is only used to pay claims if the FALs for a given syndicate prove inadequate. The following graphic illustrates this process.

If you enjoyed this article, but would like to find out more, I have also written a FAQs about Lloyd's which can be accessed through the link below:

www.lewiswalsh.net/blog/faqs-about-lloyds-of-london |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Great, simple to understand article!

Would you be able to explain also how Lloyds itself makes money? Do they charge some sort of fee for using the Lloyd's brand name?

Hi Kevin,

I'm glad you liked the article.

You're right, Lloyd's charges its members fees in exchange for allowing them to write business at Lloyd's and giving them space within the Lloyd's building. The fees are mostly based on how much Premium the company writes and how much floor space the their underwriters take up.

It's important to remember though that Lloyd's itself is not a company, and doesn't exist primarily to make money. You can think of Lloyd's as acting in a similar way to a Stock Exchange. Different parties come together to buy and sell shares at a stock exchange, but the stock exchange just charges enough fees to cover its costs. In the same way, Lloyd's just acts as a marketplace for buying and selling insurance.

If a news story says something like 'Lloyd's of London made £1 billion last year' they mean that the companies that sell insurance through Lloyd's collectively made a profit of £1 billion, not the corporation of Lloyd's itself.

Hope that helps.

Thanks,

Lewis

I'd also like to understand this. How does Lloyd's make money?

Ignore that, the page hadn't loaded and I can see now that the question has been answered.

Thank you so much for the information! I am from Malaysia and currently studying Business planning: insurance (ACA qualification). As the BPI is based on UK insurance system which I am not familiar with at all especially how Lloyd's of London works! But your article really helps a lot with my understanding. Just a token of appreciation from Malaysia! :)

very well explained

Very helpful.

A few questions if I may:

Business conducted on a subscription basis;

Do Lloyds Syndicates only co-insure with other Lloyds Syndicates?

If not (which I believe they don’t) – then do they (Lloyds) stipulate a minimum security for following company markets? Or do they only care about their percentage and the onus is on the broker/client to ensure the following markets are suitable…

If the lead insurer terms are very competitive and the following insurers do not want to subscribe at those terms, can the following markets apply their own rating for their percentage share?

If the lead insurer has granted favourable terms and you are unable to obtain support to 100% the risk, is it common, or does it happen, for a broker to revert to the lead requesting to tighten up terms to enable other insurers to subscribe?

It is my understanding that a good few Company Insurers – mainstream direct with public insurers such as Aviva – tend to have a link / arm, in some capacity, through Lloyds (trading company) – presumably for their speciality business?

Thanks in advance.

Tony

Do Lloyds Syndicates only co-insure with other Lloyds Syndicates?

> As you say below – it’s very common for Syndicates to coinsure with Companies in the London Market

If not (which I believe they don’t) – then do they (Lloyds) stipulate a minimum security for following company markets? Or do they only care about their percentage and the onus is on the broker/client to ensure the following markets are suitable…

> The insured will definitely set a minimum security level (say A-. or AA) , this would have been discussed with the broker in advance.

Whether the lead will also care about the security of the following markets is an interesting question. A Lloyd’s contract entails a separate rather than a joint liability. So if a following market defaults the lead would not be liable for their share. Because of this, my guess would be that the lead would not worry too much about the security of the following markets. That being said, no company wants to be involved in court cases and questionable deals, so if a lead might prefer not to be involved in a contract with a distressed insurer.

If the lead insurer terms are very competitive and the following insurers do not want to subscribe at those terms, can the following markets apply their own rating for their percentage share?

> My understanding is that this is not common practice. Sometimes the lead, or the lead and a couple of markets which the client views as long term strategic partners, will be given preferential terms. So different markets can end up with different terms. Also following markets may sometimes add specific wordings or other minor amendments. But on the whole, for a standard placement, the following market largely just accepts or rejects the terms negotiated by the lead market.

The Aviation market is an exception to this – it operates on what is known as a verticalised basis, whereby each insurer will separately quote without knowing what price the lead has quoted.

If the lead insurer has granted favourable terms and you are unable to obtain support to 100% the risk, is it common, or does it happen, for a broker to revert to the lead requesting to tighten up terms to enable other insurers to subscribe?

> Once a lead market has taken a line, it is not common practice to amend the terms at this point. In the event the broker is unable to obtain 100% support (which does happen every now and again), the broker will then attempt to place a shortfall cover. This is a separate contract, probably placed on more favourable terms than the main placement, which will be used to make up the difference to 100%. It is considered a bit of a faux pas for the Broker to put themselves in this position though.

It is my understanding that a good few Company Insurers – mainstream direct with public insurers such as Aviva – tend to have a link / arm, in some capacity, through Lloyds (trading company) – presumably for their speciality business?

> That’s correct – many insurance companies will provide capital for one or more Syndicates, or will own an entire syndicate. You’re correct that these syndicates will tend to focus on speciality business. The cost of transacting business at Lloyd’s is much higher than equivalent business placed through the Companies market, so the main reason Companies will still maintain Syndicates is to access business this Speciality business which they wouldn’t otherwise be able to access.

Fantastic article, explained so much that isn't very clear to anyone outside the industry.

Thank you for this article, gives a great inside to the Lloyds world with simple examples

I love this article. I'm a student and it made me understand better on how Lloyd's actually works. Thank you so much

Nice article. I just started my YouTube Channel called "Lets Talk Business" and covering Lloyds of London. You may like to have a look at https://www.youtube.com/channel/UCAVL9_FOa1w_yKGgHfMMOag

Very informative article on London Insurance Market. Thank so much!!

In the section “How do members make money at Lloyd’s?”, there is a mathematical error. 2% of 100 million is 2 Million, not 200,000 !

SK

Hi Stephen,

Thank for your comment, I've corrected the error now.

Not quite sure how I managed to mess that one up!

Thanks,

Lewis

Very helpful article for simple understanding on Lloyd's world. In real the complication of member involvement is much higher.

If I may ask,

I would like to understand Lloyd's stands on loss making syndicates. For example if a few Syndicate or members make consequent losses and requires central fund to cover the claims, how does Lloyd treat such syndicates? Do the put the syndicates to run-off / terminate the membership?

Also, Do Lloyd's in any ways guarantee the insured and re-insured to cover all claims arising from any policies written by any syndicate? even in case of the syndicate turning insolvent?

Hi Shefeek,

Glad you liked the article.

To answer your question:

The Central Fund is normally only used in cases where a Syndicate is unable to meet it's liabilities, which would effectively mean the Syndicate is already insolvent.

On occasion, the Central Fund has been used to cover losses from extreme events (such as the World Trade Centre Loss). Since these events are large and random, it would probably not be necessary to take any remedial action on Syndicates involved in the Loss.

Thanks,

Lewis

Could you please help in understanding the FAL?

Excellent article - thanks

Is it correct that syndicates can only write a specified level of premium in any one year and where premiums are increasing they will effectively write less policies by number?

For example if they have a premium capacity of £100m and have reached that by October is it correct that they cannot write any more business until January?

Hi Phil,

You're correct - syndicates agree their business plan with Lloyd's a year ahead - they submit something called a SBF (syndicate business forecast) - and if they hit that Premium limit part way through the year, there is not really much they can do.

It is particularly hard to manage when rates are increasing, as the same amount of business naturally brings in a larger premium volume.

The limits are pretty inflexible, as they are related to the amount of capital held by the syndicate, and Lloyd's takes a pretty dim view of syndicates who write beyond their premium budget.

Lewis

Syndicates are run by Managing Agents, not Managing General Agents (MGA).

The Managing Agent is the legal (Companies House) and regulated (FCA and PRA) entity, approved by the Council of Lloyd’s to run syndicates.

An MGA is a third-party insurer or in Lloyd’s speak a Coverholder.

I have just gone from being a Coverholder Broker to a Reinsurance broker and am finding your blog very informative.

Thanks.

Hi Tom,

Thanks for the comment, good spot - I'll correct it now.

I wrote this a few years ago, and I think at the time I genuinely was confused by the difference.

Glad you're finding the blog useful.

Thanks,

Lewis

Liked this article. Very informative

Super clear and helpful article.

2 questions please:

1. On the 3 year accounting example you used above, what happens to the policyholder number 4 which was only put the claim through in year 4? Does this still feed through to the member's P&L?

2. Don't members come in forms of LLV (either nameco or LLP)? Does each LLV tired with a specific syndicate? i.e. they can't switch to a different syndicate?

Hi Margaret, glad you found the article helpful.

To answer your questions:

1) From the Policyholder’s perspective, the RITC process happens behind the scenes. The Policyholder will most likely not be aware that their policy has transferred at all. If there is a claim, the Policyholder will still just submit the claim as usual to the Syndicate with whom they arranged the original policy, and the Syndicate and Lloyd’s will then arrange for the receiving syndicate to pay the claim.

The claim would not feed through to the member’s P&L (assuming we are talking about the members of the original Syndicate who wrote the policy in year 1). Once the Reinsurance to Close is completed the liability for any further claims is shifted to the Syndicate who received the RITC. It would be the members of the receiving syndicate who would have an item on their P&L statement as a result of the claim.

2) You are correct that most names will invest through some form of LLV. Though a tiny minority still invest on an unlimited liability basis. The LLV is not tied to a specific syndicate. A name can invest in multiple syndicates at once if they choose, though once they have provided capital to a syndicate they are not able to withdraw their capital until the year has closed and a reinsurance to close transaction has been completed.

Hope that helps

Thank you for the insightful article. Can you please help with the following questions:

1) How does lloyds accounting works? How is it different from UK GAAP accounting?

2) If I'm not wrong Corporate member provides capital to the Syndicate, so where does corporate member arrange this capital? and where do they present within balance sheet?

Hi Akriti,

Glad you found the article helpful. Accounting is not really my strong point, but here are my thoughts:

1) The Lloyd's annual report *is* prepared on a UK GAAP basis.

See for example page 37 of the following:

https://assets.lloyds.com/media/81b1778b-e821-4424-b21e-26e0bf095f10/Lloyds_AR21_220323.pdf

So not really sure there would be differences?

Internally, syndicates will generally also prepare management info on an Underwriting Year basis (which is different to GAAP accounting), but these would not normally be published.

Perhaps this is the difference you are referring to? In which case I'd recommend looking up 'underwriting year' vs 'financial year' vs. 'calendar year'

2) Corporate members will arrange capital from a range of sources - retained earnings, private equity investments, LOCs, bank debt, etc.

As to how this is carried on the balance sheet, I'd recommend opening an annual report from one of the companies you are interested in and checking for yourself.

Thanks for all this very useful information Lewis.If I decided to become a member of Lloyds by forming a new Nameco and commenced business on 1st January 2023 when would I first be able to draw down any profits made in the year commencing 1st January 2023?

Hi Brian,

Sorry for the slow response.

The following contains some details which might be useful:

https://assets.lloyds.com/assets/y5033/1/Y5033.pdf

For example item number 2.4.d refers to the release of potential surplus, and when this can occur.

Note the above refers to drawing down profits. If your question is more around the full release of all lodged capital, then this will not be possible until the corporate member has no involvement in any open years of account. i.e. all YOA have all RITC-ed into syndicates backed by other people.

Hope that helps.

Thanks,

Lewis

Do funds deposited within the PTF / FAL benefit from investment income?

Hi IP,

Assuming the asset which is being lodged as capital generates investment income, then this would accumulate to the benefit of the capital provider.

So in short, yes, PTF/FAL does benefit from investment income.

Thanks,

Lewis

Leave a Reply.