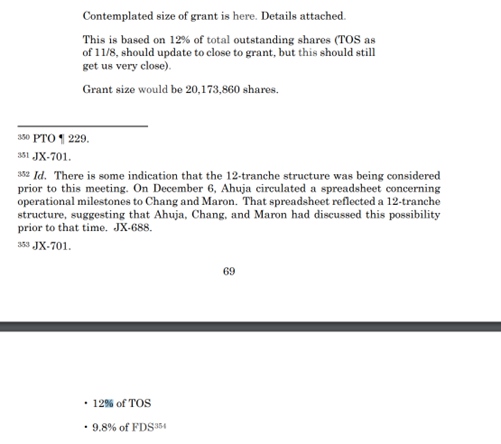

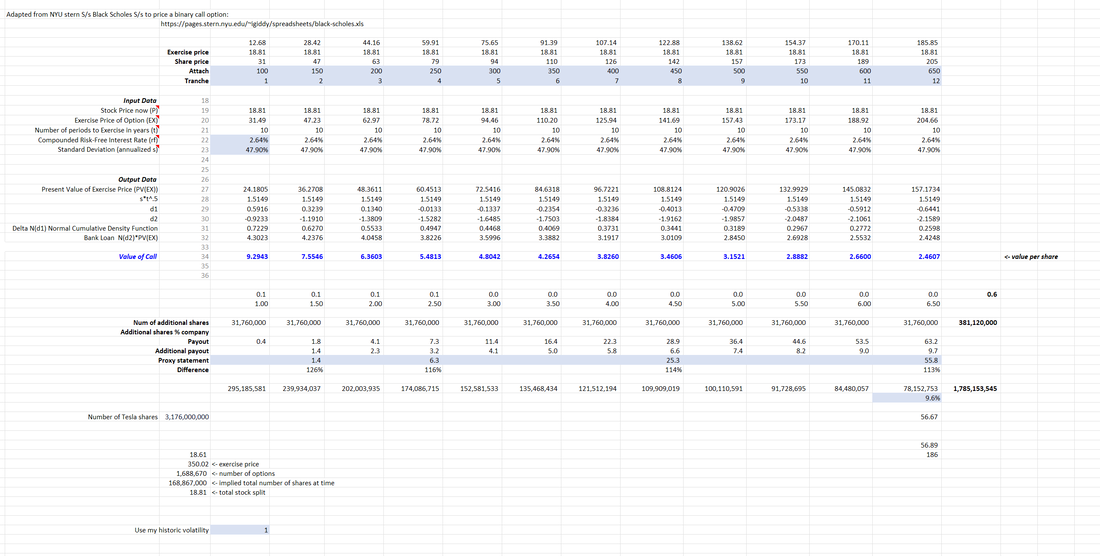

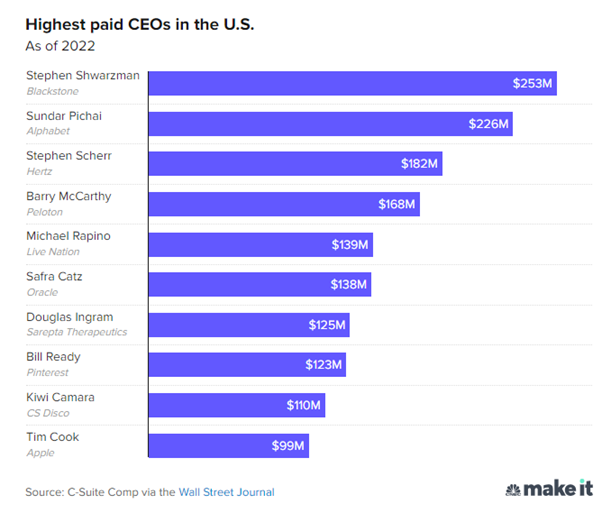

Elon Musk's pay deal26/2/2024 As a rule of thumb, news outlets like the Guardian [1] or BBC News [2] don't typically report on the decisions of the Delaware Court of Chancery, a fairly niche 'court of equity' which decides matters of corporate law in the state of Delaware. That is of course, unless those decisions involve Elon Musk. Recently, the Delaware court handed down a judgement which voided a /$56bn pay-out which was due to Musk for his role as Tesla’s CEO. The reasoning behind striking it down is quite legal and technical, and not really my area of expertise but Matt Levine has a good write up for those interested. [3] What I am interested in is thinking about how we would assess the fairness of the pay-out. Now fairness is a slippery concept, but I'm going to present one angle, which I've haven't seen discussed elsewhere yet, which I think is one possible way of framing the situation. Source: https://en.m.wikipedia.org/wiki/File:Roadster_2.5_charging.jpg Assessing fairness My contention is that it is instructive to look at how reasonable the remuneration package was at *the date it was awarded*. Musk's options ended up being worth /$56bn, but that's only because Tesla’s share price performed incredibly well, had Tesla's shares performed poorly, then Musk would be due much less than /$56bn, and could even potentially have been due nothing at all. I don't think its appropriate to analyse the situation solely in terms of the /$56bn given the /$56bn was not a guaranteed outcome and could very well have come out at a different number. To put it in different terms, if someone offered an employee the option of a /$100 bonus in cash, or /$100 of lottery tickets, then when deciding whether the bonus was fair, the relevant perspective would be 'is /$100 a reasonable amount to spend on bonuses'. It would be unfair to wait to see if they win, and then judge the fairness of the bonus based on whether they had a winning or losing lottery ticket. So in order to get a sense of whether the package was fair when awarded, I thought I’d try to do the calcs to see how much the stock options were worth to Musk in 2018. The proxy statement First step, we need to figure out the precise details of the package. Various news articles give the basic outline as 'Musk would be awarded 1% of the outstanding shares if the market cap got above /$100bn, and then an additional 1% of the shares for each additional of /$50bn market cap, up to a max of 12% of the shares'. i.e. If the market cap only grew to /$110bn, he would have just got 1%, but if it grew to /$650bn, then he gets the full 12%. The proxy statement [4] explains in full detail, and the specific mechanics are that Musk was to be awarded vanilla call options with a exercise price set to be the current stock price in 2018. Based on the informal description in various news sources, I initially thought that he was going to just be awarded that number of shares, rather than being given a call option (i.e. an asset-or-nothing call option). If he has just been awarded the shares, in the most optimistic scenario he would effectively be paid 12%*/$650bn = /$78bn, whereas with the vanilla call options he would effectively be paid 12%*(/$650bn - /$57bn) = /$63bn instead. So it's important we value these as vanilla call options, not as asset-or-nothing call options. Another adjustment then needs to account for the effect of dilution, even though Musk could be awarded up to 12% of shares, this would be closer to an effective 10% of the company once dilution is accounted for. The post-trial opinion from Judge McCormick [5] contains values for these (as far as I’m aware I don’t think you could calculate them just based on public info). I’ve pasted the relevant section below. To sense check this, the proxy statement gives a value of /$56bn if the market cap hits /$650bn. We can recreate this using the following calc: 9.6%*(/$650bn-/$57bn) = /$57bn, which is close enough. No upper limit Another point to make is that there is no upper limit to what these options might be worth. If Tesla’s share price had hit /$2trillion, then the options would have been worth /$186bn! I found some articles from the time, for example this one in the Guardian [6], which seem to imply that the maximum possible pay out was /$56bn, which is incorrect, this is the payout when the final tranche of options are released, which is the highest value mentioned in the proxy statement, but the sky is the limit with these things. Okay, so now let’s actually value the stock options, I used a Black-Scholes model in a Spreadsheet to price the 12 tranches of options (and I know Black-Scholes doesn’t really work, and caused the 2008 financial crisis, but I’m not going to be trading trillions of dollars of derivatives based on it, and it should work reasonably well as a first approximation.) Here is a screenshot of the model, but you can also download it from the following link: github.com/Lewis-Walsh/Valuation_of_2018_Musk_pay_deal Based on my model, the options were worth around /$1.8bn at the time they were awarded. Given this might have been the only compensation that Musk would have received in 10 years, we should then spread the cost of the options across the 10 years, so we could say they were worth /$180m pa. There’s probably an argument for using a period shorter than 10 years, as really this should be the average duration of the options given they might be exercised early, but let’s just keep the maths simple and use 10 years. So this means, that Tesla could have purchased call options in the open market which replicated the payout pattern of those granted to Musk for /$1.8bn plus some sort of margin, and Musk's mean expected compensation per year is around /$180m. Benchmarking Now let’s benchmark the /$180m against what other CEOs are being paid. The highest paid CEOs in 2022 were the following (I used 2022 as it's approx. 50% through the contract length, and we want to recognize the impact of some inflation across the 10 years) /$180m puts Musk basically joint 3rd highest paid CEO when compared to 2022 remuneration. This definitely benchmarks as a high package, but certainly not anything unprecedented in generosity.

Conclusions Just to preempt possible comments on the above analysis, I'm acutely aware that there are many considerations I haven't incorporated, e.g. should anyway ever get paid /$56bn? Was this package really needed to incentivise Musk given he already have a material equity stake, did Tesla appropriately inform shareholders of the process which was used to arrive at the pay deal, etc. etc. But I do think the above perspective on the deal, thinking about what we would have thought before we knew how things turned out, is an important perspective when thinking about fairness. [1] https://www.theguardian.com/technology/2024/jan/30/elon-musk-tesla-pay-package-too-much-judge-rules [2] https://www.bbc.co.uk/news/business-68150306 [3] https://www.bloomberg.com/opinion/articles/2024-01-31/elon-musk-is-overpaid [4] https://www.sec.gov/Archives/edgar/data//1318605/000119312518035345/d524719ddef14a.htm [5] https://courts.delaware.gov/Opinions/Download.aspx?id=359340 [6] https://www.theguardian.com/technology/2018/jan/23/elon-musk-aiming-for-worlds-biggest-bonus-40bn |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Leave a Reply.