|

In case you missed it, Aon announced [1] last week that in response to the Covid19 outbreak, and the subsequent expected loss of revenue stemming from the fallout, they would be taking a series of preemptive actions. The message was that no one would lose their job, but that a majority of staff would be asked to accept a 20% salary cut. The cuts would be made to:

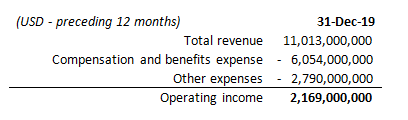

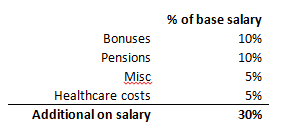

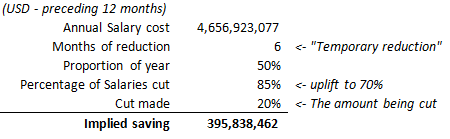

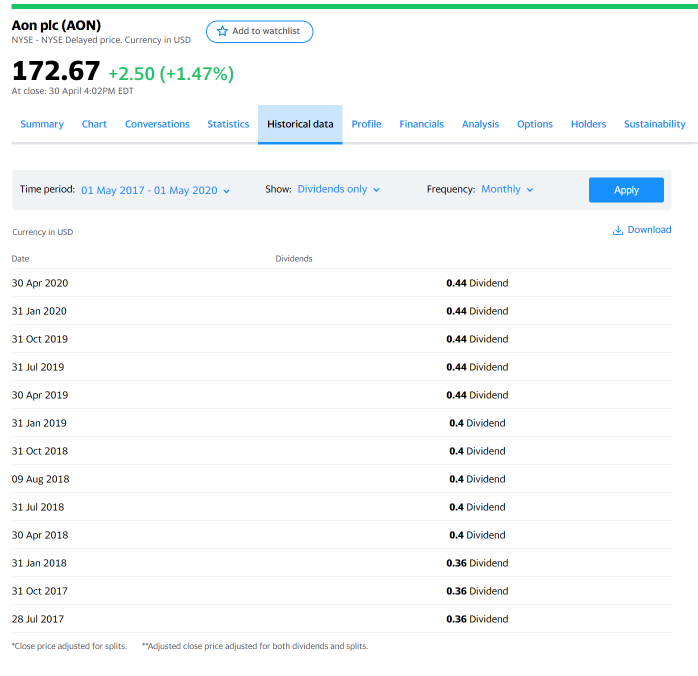

So how significant will the cost savings be here? And is it fair that Aon is continuing with their dividend? I did a couple of back of the envelope calcs to investigate. Estimating Salary costs using Aon's Earning Report As a starting point we need to know how much Aon spends on salaries in the first place. Their Q4-19 Earnings Release, which was the most recent available when I started writing this, can be found here: d18rn0p25nwr6d.cloudfront.net/CIK-0000315293/422df0de-c031-486e-bf9f-bda8b9d353a6.pdf Based on this, we see that Aon had the following revenue and operating income for FY19: So the total staff bill was approx. USD 6bn. The announcement stated that the 20% cut would be made to "salaries" therefore I’m assuming other benefits will not be cut, so we will need to split the USD 6bn into base salary vs other staff benefits. Here is a table (which I completely made up), but should hopefully be of the correct order of magnitude: So based on this, of the USD 6bn of compensation related expenses, I’d estimate something like USD 4.6bn corresponds to base salaries, and USD 1.4bn relates to the other categories listed above. The reason Aon is cutting salaries of only 70% of employees rather than all employees is to protect the less well paid (the calculation will apparently be based on a cost of living level which will vary by location) The idea being, Aon doesn’t want to cut the salary of someone who lives in London and earns 17k pa down to 13.6k. The effect of this is that as a percentage of the total salary cost, the 20% cut will be made to more than 70% of the total salary bill, as the cut will be skewed to higher paid employees. I’m going to assume that rather than 70%, the cut will represent approx. 85% of the total salary cost. Once again, completely made up but we need to make an adjustment here, and a 15% increase seems reasonable. The actual number is going to be greater than 70% and less than 100% so our final answer shouldn't be too sensitive to this assumption either. The announcement stated that the reduction would be temporary, it’s not clear what exactly this means in terms of time-frame, so I’m making the assumption that the cut will last for 6 months. Combining all of the above we get the following: So this move can be expected to save Aon something like USD 400m in salary expenses if applied for 6 months. How much is Aon’s Dividend? To see this I went to Yahoo Finance and looked up Aon Plc. Aon paid dividends of USD 0.44 per share quarterly for an annualised USD 1.76 per share. They’ve increased their dividend at a steady 10% per annum. The number of shares outstanding is 231.08m, giving a total annual dividend payment of USD 407m for the latest 4 quarters. On the face of it then, we’ve got Aon cutting staff costs by approx. 400m as per the above, but then continuing to pay a dividend of …. 400m. Hmmm…. In Aon management's defence, the other part of announcement was the intention to pause the share buyback scheme. This is where the numbers gets interesting, Aon’s used this scheme to purchase over USD 2bn of stock in the last 12 months. That's money which has been returned to shareholders. Therefore by halting this program, assuming Aon would have purchased a similar amount in the next 12 months, Aon is immediately saving a further 2bn, money which would have otherwise gone to shareholders. So is this fair? This is where I think you can argue in either direction in terms of fairness. On the one hand, why should the middle 70% of employees have their salaries cut when Aon is intending to continue to pay a dividend to shareholders, and when over 2.4bn was paid out to shareholders last year. This was money which could have been used to pay down debt (which currently stands at around 9bn), and ensure that should any adverse events occur, the company does not need to take such drastic actions such as cutting salaries to protect cashflow and liquidity. On the other hand, we could say to ourselves - shareholders are going from an annual 2.4bn payout to just 400m an 83% reduction, the executive team is having their pay cut by 50%, and the lowest paid are not having their salary cut at all. Given shareholders are taking a 83% hit, execs a 50% hit, is it unreasonable to ask the middle 70% to take a temporary 20% cut? [1] Aon's SEC filing here: d18rn0p25nwr6d.cloudfront.net/CIK-0000315293/337574c0-e686-4571-9f77-1f8af576f692.pdf |

AuthorI work as an actuary and underwriter at a global reinsurer in London. Categories

All

Archives

April 2024

|

RSS Feed

RSS Feed

Stock buybacks do not occur in down years so Aon investors really haven't given up anything at all. Worse still, Aon's senior executive pay cut of 50% is only against weekly salary which is about 10% of senior executive comp. The senior execs make millions in stock grants and dividends which are not being preserved. Investors and senior management win whilst employees lose.

I think he means the millions in stock grants and dividends for senior management are being preserved whilst the employees suffer.

Leave a Reply.